What Does the Real Estate Market Currently Look Like?

An Analysis by Anna Geher and Sonja Ressler

A look at Southeast Asia. The real estate market in Malaysia, like in Europe, has been affected by the pandemic and global political influences. The impact on the real estate market shows some similar trends. Below, we will examine both the general economy and the residential, office, retail, and commercial markets in Malaysia.

Economy

Malaysia, with approximately 33.9 million inhabitants (2022), is a relatively small economy that nevertheless ranks 24th among the world’s leading export nations. Malaysia is highly export-oriented and follows an open and liberal economic policy. The country boasts a well-developed financial services sector and is a global leader in Islamic finance.

The Malaysian economy grew by 3.3% in the third quarter of 2023, driven by domestic demand, improved labor market conditions, a further recovery in tourism activities, and increased construction activity. Against this backdrop, Bank Negara Malaysia (BNM) maintained its GDP growth forecast of 4% for the entire year 2023.

Overall inflation declined to 2% in the third quarter of 2023. Although the overall inflation rate is significantly lower than that of some of the country’s regional competitors, existing subsidies for electricity tariffs and fuel, as well as price caps on certain essential food items, will remain in place. Looking ahead, inflation is expected to decline further by the end of the year.

Regarding lending, the central bank decided to keep its Overnight Policy Rate (OPR) at 3% in November 2023, after raising it from 2.75% to 3% in March 2023.

Office

In the second half of 2023, four new office buildings were completed in the Klang Valley (the metropolitan area surrounding Kuala Lumpur and Putrajaya), adding approximately 280,000 m² of rentable space to the market.

The submarket of KL City (home to the famous Petronas Towers) continues to face pressure due to this growth, while the office markets in KL Fringe and Selangor have proven to be more resilient, characterized by steady leasing activity, particularly in prime locations with Class-A buildings.

Co-Working-Spaces are trending

The co-working space sector continues to flourish, driven by sustained demand from a variety of users, evolving work styles, and an increasing preference for flexible office solutions.

In the second half of 2023, there was an increase in office transactions, with five deals in KL City and Selangor totaling 837.8 million Ringgit (approximately 159 million euros).

During the reporting period, rental rates for prime office spaces in KL City ranged from 5 to 14 Ringgit per square foot, equivalent to approximately €10.20 to €28.60 per square meter. In the KL Fringe submarket, rental rates ranged between 6 and 9 Ringgit per square foot (€12.20 to €18.40 per m²). In Selangor, similar quality office spaces commanded monthly rents of up to 7.50 Ringgit per square foot (€15.30 per m²).

Looking ahead, the Klang Valley office market is expected to remain stable and experience a slight recovery, supported by ongoing demand for office space from sectors such as technology, finance, and professional services, driven by the trend towards quality and the growing focus on ESG factors.

Retail

In the second quarter of 2023, retail sales in Malaysia fell short of market expectations, shrinking by 4% year-on-year.

The decline is attributed to diminishing purchasing power due to high inflation. The country’s retail sales growth forecast for the full year 2023 has been revised down from the previous estimate of 4.8% to 2.7%.

The total retail space supply in the Klang Valley stands at approximately 6.5 million square meters, with the recent completion of The Exchange TRX. The Exchange TRX houses over 500 experiential stores, featuring several foreign brands entering the Malaysian market for the first time, including Gentle Monster, Maison Kitsune, Alo Yoga, and Drunk Elephant. Seibu, one of Japan’s largest department stores, is the anchor tenant, offering over 400 luxury fashion brands and premium Japanese dining options.

Next year, three more shopping centers with a combined retail space of approximately 160,000 sq m are set to open.

Despite rising cost pressures from higher operating expenses, owners and operators of prime shopping centers in the Klang Valley have reported higher revenues and net yields, driven by increased tenant sales, growing footfall, and sustained occupancy rates.

The retail icons in Kuala Lumpur City, Suria KLCC and Pavilion Kuala Lumpur, achieve average monthly gross rents of approximately €80 and €57 per m², respectively. Occupancy rates for these centers are reported to be 92% and 91.6%, indicating strong performance.

In Kuala Lumpur Fringe, Mid Valley Megamall and The Gardens Mall generate average monthly gross rents of approximately €35 and €25 per sq m, with occupancy rates of around 99.5% and 97%, respectively.

ESG Strategies are Gaining Importance.

Sustainability and ESG themes are making an increasing impact on the local retail scene. Supported by regulatory and financial institutions, more retailers and shopping center operators are taking proactive steps towards sustainability and aligning their strategies with ESG standards.

Industry/Logistics

In the second half of 2023, the commercial property sector in Klang Valley saw no less than nine major transactions, each exceeding €5.7 million in value.

Malaysia ist nach wie vor ein beliebtes Drehkreuz für Investitionen

im Sektor Data Center in der Region.

Investments in data centers in Malaysia have risen exponentially from 2021 to March 2023, totaling 76 billion Ringgit (approximately 14.4 billion euros). The contribution of the digital economy to the country’s GDP is expected to reach 25.5% by 2025.

The Malaysian Industrial Production Index (IPI), which has been gradually increasing since the first quarter of 2022, recorded quarterly declines of 3.2% and 2.4% in the first and second quarters of 2023, before rising again by 4.2% in the third quarter of 2023. This growth was supported by a 5.5% increase in manufacturing and a slight 0.7% uptick in the mining sector. Year-on-year, the IPI remained unchanged. Key sub-sectors that saw index declines of more than 5% include pharmaceuticals and preparations, textiles, and petroleum products. In contrast, the production indices for tobacco products, the reproduction of recorded media, and fabricated metal products registered high growth rates (annual growth of 13.8%, 9%, and 8%, respectively).

Over the past year, there have been no significant changes in rental rates for industrial and logistics properties. Monthly rents vary depending on location and project, accessibility, land size, infrastructure, amenities, and other factors, ranging from approximately €2 to €5.10 per sq m. Land prices range from around €130 to €700 per sq m.

Residential Living

In the Federal Territory of Kuala Lumpur (WPKL; population approximately 1.8 million), a total of 7,446 (serviced) apartments and condominiums changed hands in the first three quarters of 2023, with a total transaction value of 6.1 billion Ringgit (approximately 1.2 billion euros).

Despite a 5.6% increase in the number of transactions, the total transaction volume remained the same as the previous year (2022: 7,052 transactions with a value of 6.1 billion Ringgit). This means that the average value per transaction was 5.2% lower than the previous year. Nevertheless, a positive price trend continued for resale high-end apartments and (serviced) apartments. Overall, the average transaction prices in the high-end residential segment were 1.9% higher in the second half of 2023 compared to the first two quarters.

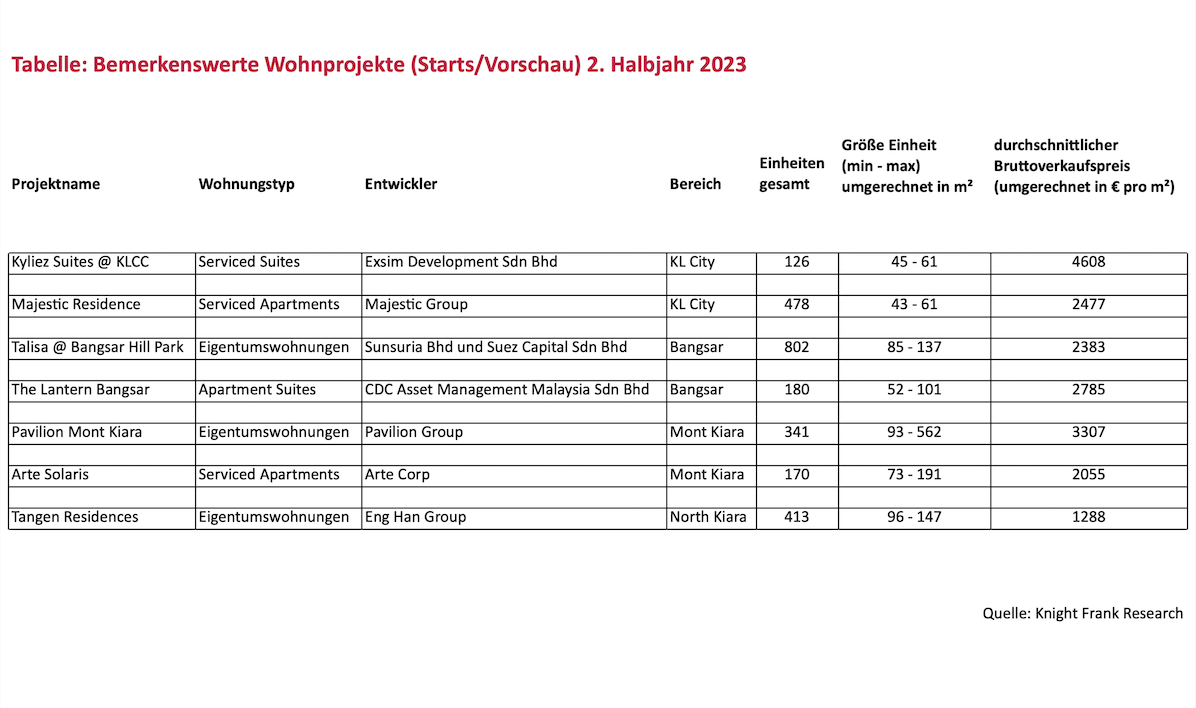

The supply of new residential properties has significantly declined nationwide and in Kuala Lumpur. In 2023, there was a 16.1% drop in nationwide supply (Q1–3 2023: 403,914 units/2022: 481,310 units) and a 13.5% drop in Kuala Lumpur (Q1-3 2023: 64,762 units/2022: 74,863 units). Last year, approximately 3,100 high-end units were completed, and several noteworthy developments with a total of around 2,500 planned units were launched, including the “Kyliez Suites” project in KL City with 126 planned serviced suites and “Majestic Residence” with 478 serviced apartments. Average prices range from €2,480 to €4,610 per m² in KL City, €2,380 to €2,790 per sq m in Bangsar, and €2,060 to €3,310 per sq m in Mont Kiara (see the above table).

Average rental prices ranged between €4.10 and €11.90 per sq m, with a stagnating or increasing trend observed, except in Mont Kiara. It is expected that the rental market will continue to develop positively in the future.

The most important findings:

A positive price trend can be observed for resale high-end apartments and (serviced) apartments, while the supply of new residential properties is decreasing. A positive development in the residential rental market is expected.

The office market in Klang Valley is expected to remain stable, and the co-working sector continues to flourish.

There is a noticeable trend toward ESG strategies in both office and retail spaces.

The industrial sector remains stable, with increasing investments in data centers in Malaysia.

Text

Anna Geher, BSc, CIS ImmoZert MRICS & Mag. (FH) Sonja Ressler, CIS ImmoZert REV

Redaktion

Österreichische Zeitschrift für Liegenschaftsbewertung (Austrian Journal of Property Valuation)

Fotos

nazar_ab/iStock, Christian Steinbrenner